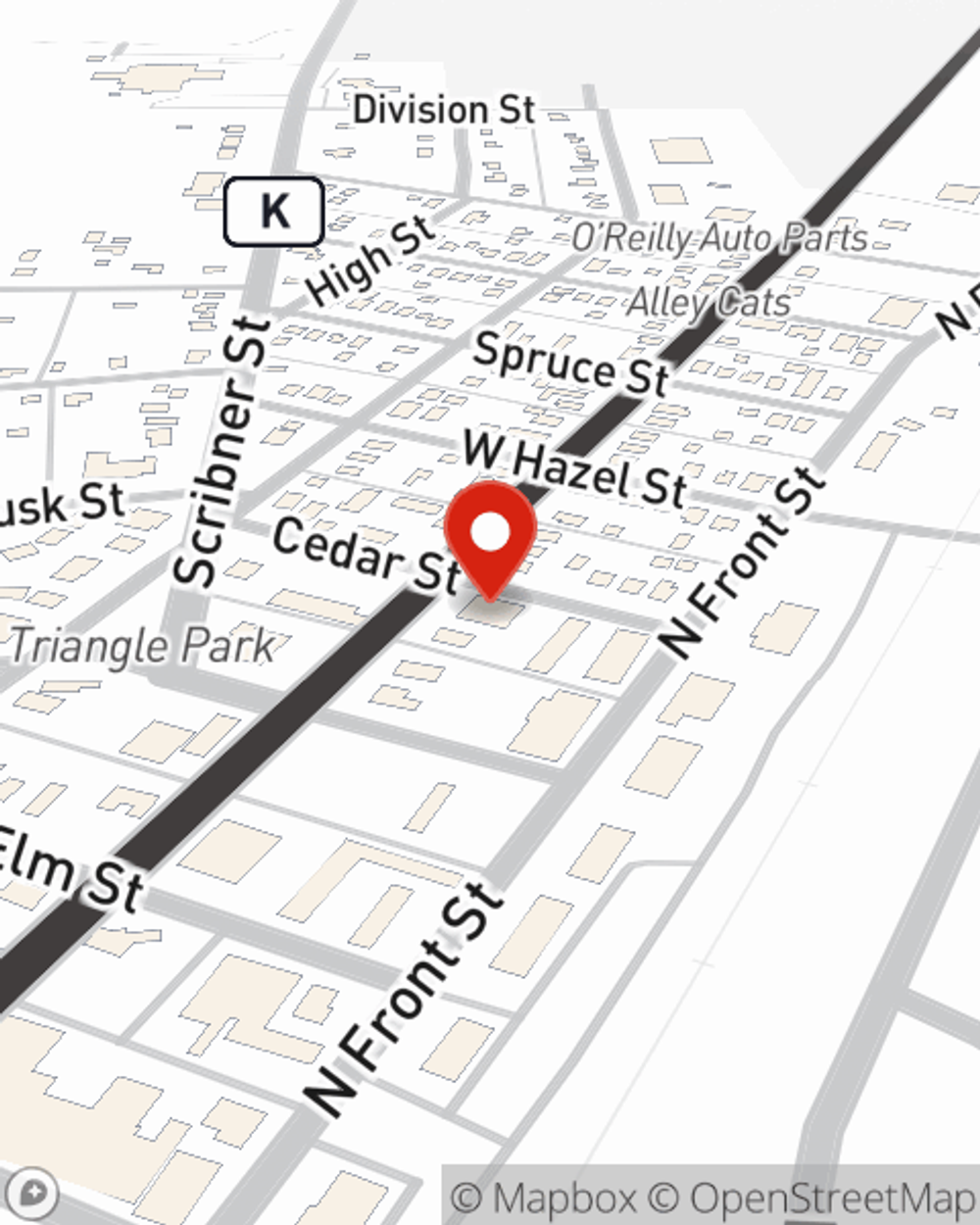

Life Insurance in and around Spooner

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Spooner

- Shell Lake

- Minong

- Birchwood

- Trego

- Siren

- Webster

- Danbury

- Washburn County

- Burnett County

- Rice Lake

- Hayward

- Sawyer County

- Haugen

- Douglas County

- Gordon

- Solon Springs

Your Life Insurance Search Is Over

It may make you uneasy to entertain ideas about when you pass, but preparing for that day with life insurance is one of the most significant ways you can show care to your loved ones.

Get insured for what matters to you

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less overwhelming for your partner and provide space to grieve. It can also help cover matters like grocery bills, home repair costs and your funeral costs.

When you and your family are protected by State Farm, you might rest easy knowing that even if something bad does happen, your loved ones may be protected. Call or go online now and see how State Farm agent Tim Reedy can help you protect your future.

Have More Questions About Life Insurance?

Call Tim at (715) 635-9510 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.