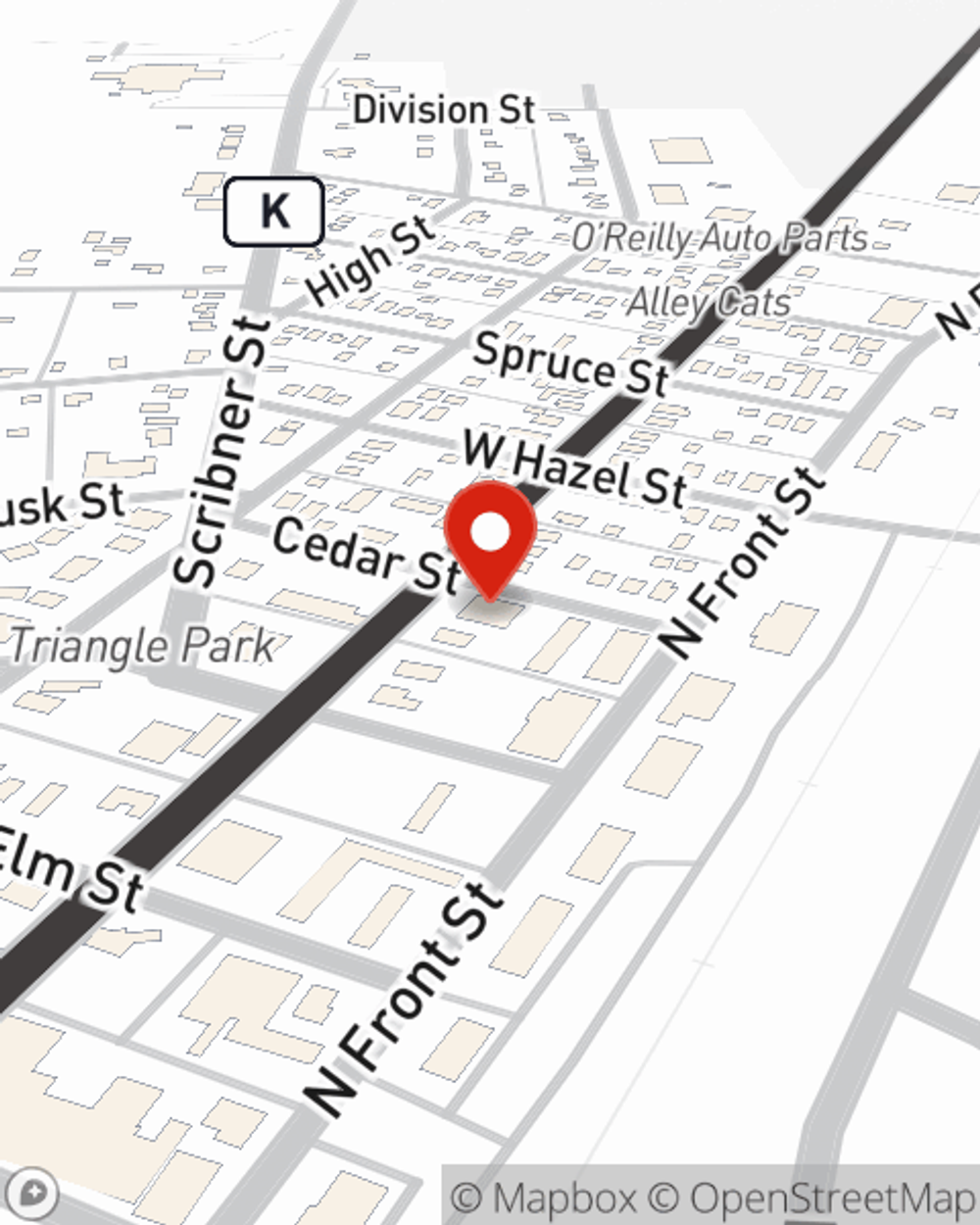

Homeowners Insurance in and around Spooner

Homeowners of Spooner, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Spooner

- Shell Lake

- Minong

- Birchwood

- Trego

- Siren

- Webster

- Danbury

- Washburn County

- Burnett County

- Rice Lake

- Hayward

- Sawyer County

- Haugen

- Douglas County

- Gordon

- Solon Springs

Welcome Home, With State Farm Insurance

Committing to homeownership is a big deal. You need to consider your future needs location and more. But once you find the perfect place to call home, you also need great insurance. Finding the right coverage can help your Spooner home be a sweet place to be.

Homeowners of Spooner, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Open The Door To The Right Homeowners Insurance For You

Agent Tim Reedy has got you, your home, and your belongings guarded with State Farm's homeowners insurance. You can call or go online today to get a move on creating a policy that fits your needs.

Your home is the place where your loved ones gather, but unfortunately, the unanticipated circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Tim Reedy can help you get the information you need!

Have More Questions About Homeowners Insurance?

Call Tim at (715) 635-9510 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Simple Insights®

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.