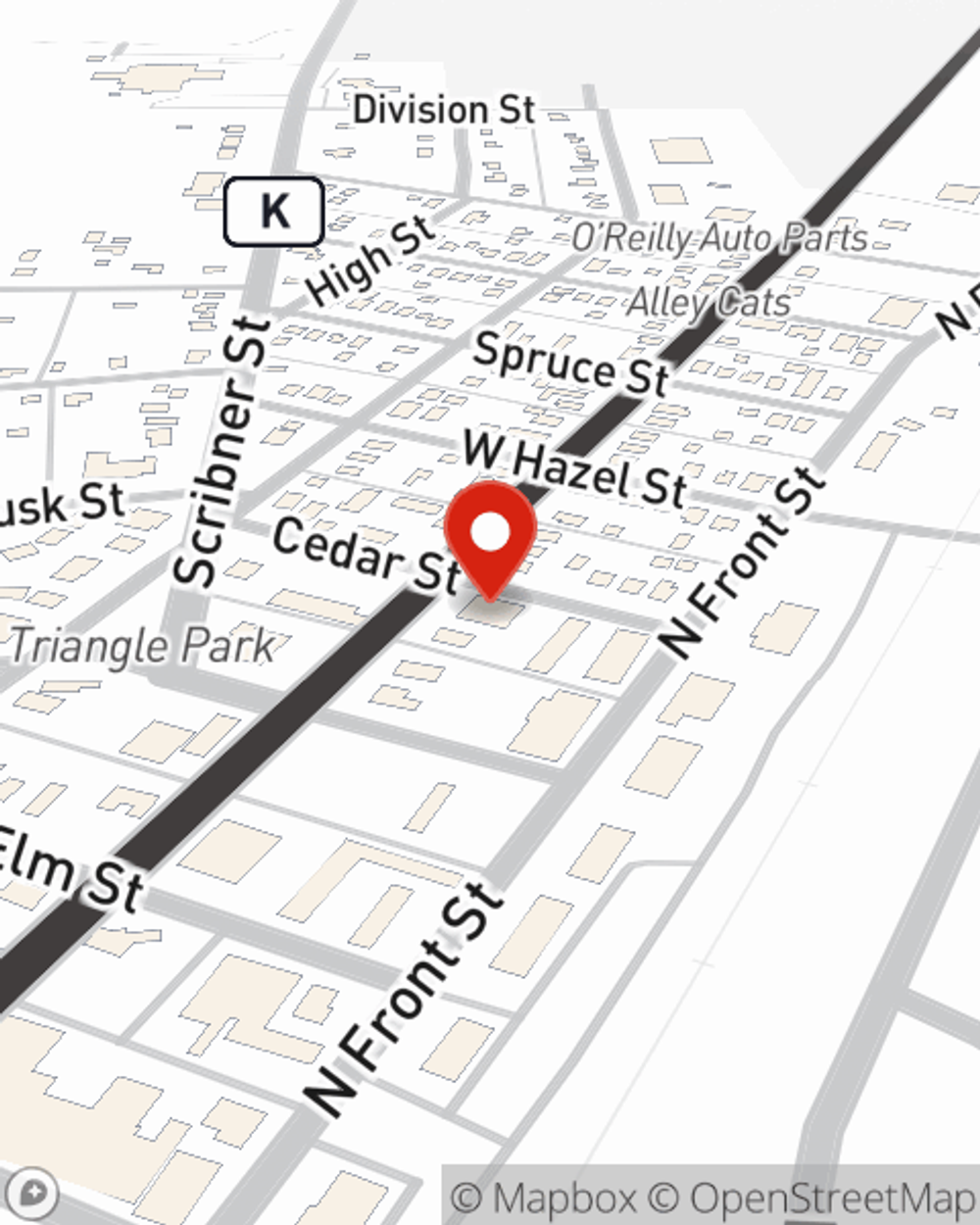

Business Insurance in and around Spooner

Spooner! Look no further for small business insurance.

This small business insurance is not risky

- Spooner

- Shell Lake

- Minong

- Birchwood

- Trego

- Siren

- Webster

- Danbury

- Washburn County

- Burnett County

- Rice Lake

- Hayward

- Sawyer County

- Haugen

- Douglas County

- Gordon

- Solon Springs

State Farm Understands Small Businesses.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or accident. And you also want to care for any staff and customers who hurt themselves on your property.

Spooner! Look no further for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

With options like worker's compensation for your employees, business continuity plans, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Tim Reedy is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Don’t let fears about your business stress you out! Reach out to State Farm agent Tim Reedy today, and discover how you can benefit from State Farm small business insurance.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Tim Reedy

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.